With a $20M boost, Slang.ai is set to innovate retail and dining with voice AI.

Slang's solution ensures that no call to a brick-and-mortar business goes unanswered, replacing voicemails with a synthetic-voiced robot concierge.

Funding Round Info:

Slang recently secured a significant investment in a Series A funding round, with Homebrew taking the lead and Stage 2 Capital, Wing VC, Underscore VC, Active Capital, and Collide Capital also participating. The funds are earmarked for several key areas of growth and development. Firstly, Slang plans to expand its team, bringing in new talent to drive innovation and service delivery. Secondly, the company aims to extend its voice concierge service to a wider range of industries, broadening its market reach. The capital infusion also paves the way for Slang to invest in new integrations, such as reservation management platforms, which will enhance the functionality and versatility of its service. Lastly, the funding will fuel the development of more advanced product capabilities, leveraging the power of generative AI to deliver a superior customer experience.

About Slang.ai:

Slang.ai is a pioneering technology company that specializes in voice-enabled artificial intelligence (AI) solutions. Its primary offering is an advanced voice AI service designed to automate phone answering for businesses. This service is particularly beneficial for the retail and restaurant sectors, ensuring that no customer call goes unanswered by replacing traditional voicemails with a synthetic-voiced robot concierge. Slang.ai is also investing in new integrations, such as reservation management platforms, to enhance its service and customer experience. With its innovative technology and commitment to improving customer interactions, Slang.ai is set to redefine the way businesses handle customer calls.

About Homebrew:

Homebrew is a seed venture capital firm that provides both capital and operational expertise to mission-driven entrepreneurs. The firm is committed to partnering with founders who are solving large, urgent, and valuable problems, and who are intent on building durable, meaningful companies. Homebrew invests as early as possible and beyond, devoting dollars, time, and reputation to the success of the startups they back. They aim to help build the foundational elements of a fantastic startup, including clear product/market fit, a stellar team, a well-defined culture, a robust go-to-market strategy, and access to more capital. Homebrew's approach is designed to increase the probability, velocity, and scale of their portfolio companies' success.

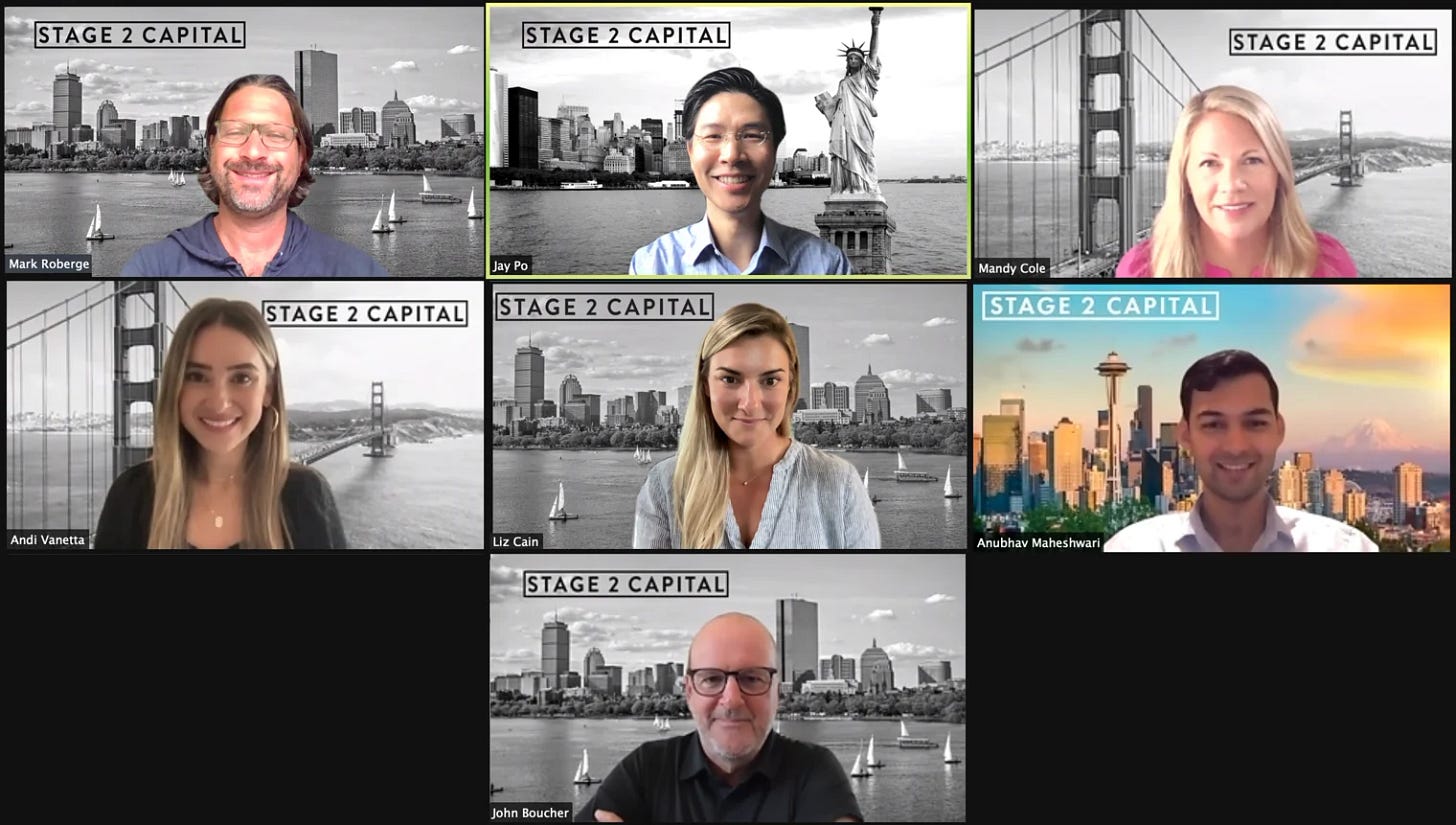

About Stage 2 Capital:

Stage 2 Capital is a unique venture capital firm that is run and backed by over 500 go-to-market leaders. The firm invests in a variety of sectors including FinTech, Dev Tools, Video, Creator Economy, Healthcare IT, Marketplaces, Application SaaS, and Vertical Software. Stage 2 Capital not only provides capital but also matches its portfolio companies with seasoned go-to-market executives from its LP base to meet their strategic and operational needs. This involvement can range from joining a portfolio company as an executive, board member, or advisor. The firm employs a two-person investment pod model, combining the strengths of a partner with traditional VC/finance experience and another with go-to-market operator experience. Stage 2 Capital's community supports founders as they achieve product-market fit and prepare to scale revenue. The firm also offers scientific, data-driven methodologies to help founders drive sustainable revenue.

About Wing VC:

Wing Venture Capital is an early-stage investor and long-term company builder that is dedicated to equipping founders with resources and unwavering partnership. The firm is focused on investing in companies that are innovating in the fields of autonomous apps, AI, data, and product-led growth (PLG). Wing's mission is to enable the AI-first technology stack and it invests in companies innovating at all levels of this stack. The firm also provides a dedicated team, sought-after connections, and resources designed for early-stage companies through its Founder Success Platform. Wing's investment approach is centered on the belief in a future that is built on data, powered by AI, and put to work through increasingly autonomous applications.

About Underscore VC:

Underscore VC is a Boston-based venture capital firm that specializes in backing bold, seed-stage founders. The firm stands out by surrounding early-stage founders with a curated expert community known as the Underscore Core. This community provides the right expertise, from the right people, at the right time, all funded by Underscore VC. The firm invests in a variety of sectors and is committed to helping founders build enduring companies. Underscore VC also offers a series of proven frameworks and honest case studies from experienced entrepreneurs, known as Startup Secrets, to help early-stage tech founders go from idea to IPO. The firm's unique approach and commitment to diversity, inclusion, and sustainability make it a distinctive player in the venture capital landscape.

About Active Capital:

Active Capital is a seed-stage venture firm that specializes in supporting ambitious founders building the future of cloud infrastructure and B2B SaaS. The firm, which is based in Texas but invests all over, is designed to lead seed rounds for B2B SaaS companies. Active Capital is the result of the team's extensive experience as founders and operators who have built companies and cultures worth millions and billions. The firm prefers to invest in companies that can get to market with very little capital and believes it can best help founders once they start to grow. The team at Active Capital includes seasoned entrepreneurs and operators who have been starting, building, and investing in B2B SaaS and cloud infrastructure businesses for over 20 years.

About Collide Capital:

Collide Capital is a venture capital firm that aims to guide founders on their institutional capital journey and equip them with resources, knowledge networks, and hands-on operational support for a successful exit. The firm was founded by Aaron Samuels and Brian Hollins, who have built two of the largest Black tech ecosystems, AfroTech and BLCK VC. Collide Capital invests in early-stage companies from pre-seed to Series A, focusing on founders building transformational enterprise SaaS, supply chain infrastructure, and Gen-Z minded consumer software. The firm believes that great companies are built at the intersection of communities led by diverse, fearless change agents and seeks to back a high-performing portfolio led by a diverse array of founding teams.