Typeface Raises $100M at a $1B Valuation for Developing Generative AI for Brands

Riding the wave of generative AI hype, Typeface rapidly gained Fortune 500 clients, partnered with Salesforce and Google Cloud, and recently secured significant investor funding.

Funding Round Info:

Today, Typeface completed a $100 million Series B funding round, led by Salesforce Ventures and featuring contributions from Lightspeed Venture Partners, Madrona, GV, Menlo Ventures, and M12. This propelled the startup's valuation to $1 billion and its total funds raised to $165 million. CEO Abhay Parasnis revealed plans to use this capital to expand Typeface's platform and team. Parasnis communicated the need for an AI platform that caters to enterprise-specific requirements, fosters innovation, naturally integrates with brand identity, and ensures content security and workflow integration.

About Typeface:

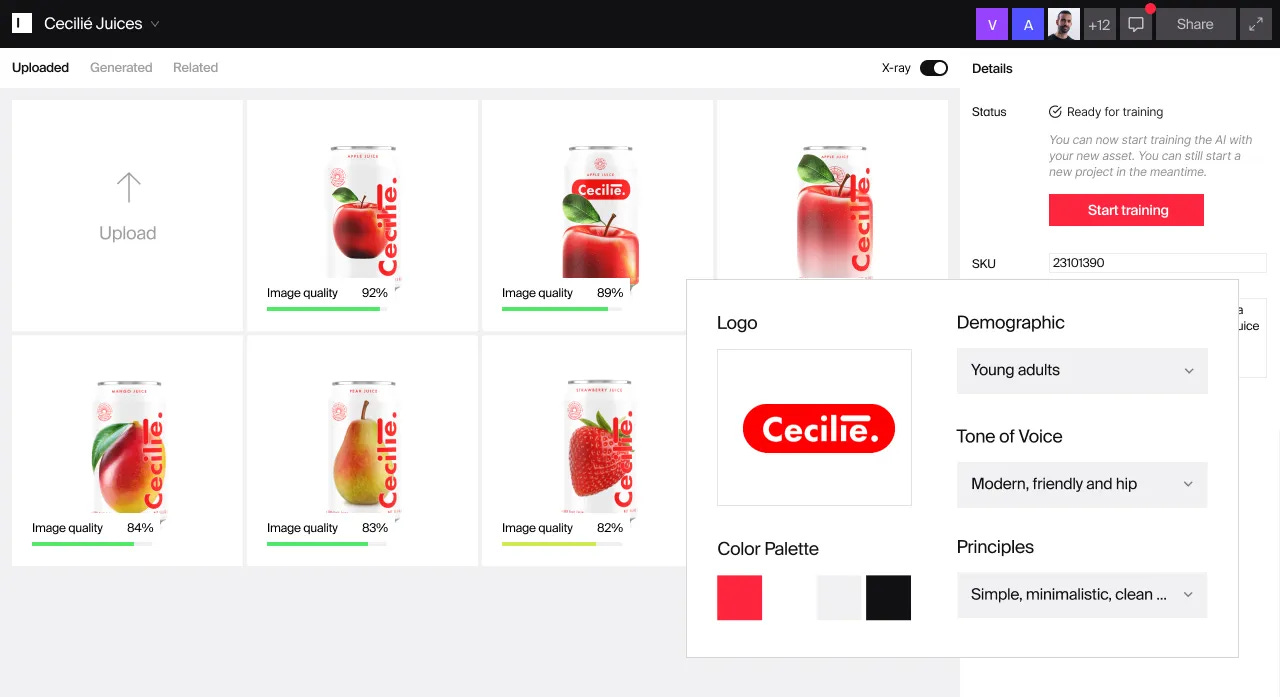

Typeface is a generative AI startup founded by former Adobe CTO, Abhay Parasnis. The company, valued at $1 billion, uses AI to create personalized content for brands at scale. It recently raised $100 million in Series B funding to expand its platform and team. The platform consists of a content hub, an AI tool for personalizing content, and a workflow integration system. Typeface emphasizes brand governance, content safety, and privacy, providing dedicated AI models for each customer. The company aims to revolutionize content delivery in enterprises with its technology.

About Salesforce Ventures:

Salesforce Ventures is the investment arm of Salesforce, dedicated to fostering innovation and growth in the enterprise software space. Since its inception in 2009, Salesforce Ventures has partnered with and invested in over 400 enterprising companies, from seed stage to IPO. Their portfolio includes notable companies such as Airtable, Databricks, DocuSign, Guild Education, Hopin, monday.com, nCino, Snowflake, Snyk, Stripe, Tanium, and Zoom. Salesforce Ventures is committed to helping ambitious founders build companies that reinvent the way the world works. They have recently expanded their Generative AI Fund to $500 million, further demonstrating their commitment to advancing AI technology.

About Menlo Ventures:

Menlo Ventures is a Bay Area venture capital firm that is deeply committed to investing in early-stage companies across consumer, enterprise, and healthcare technologies. They believe in a hands-on approach, working closely with visionary founders to help groundbreaking ideas come to life. Menlo Ventures doesn't just provide funding, they also offer their expertise and resources to help their portfolio companies navigate every stage of growth. They have a dedicated team that is all in when it comes to supporting their companies. In addition to investing, Menlo Ventures also has an initiative called Menlo Labs, which works alongside founders to start companies from the ground up. Their investment philosophy is centered around the belief in transformative technology companies that are changing the way we live and work.

About Madrona:

Madrona Venture Group is a venture capital firm that partners with technology entrepreneurs to transform ideas from startup to market success. They are committed to backing founding teams in seed, early, and acceleration stages in the Pacific Northwest and beyond. Madrona Venture Group is known for its active, full-stack partnership approach, working closely with founders to turn conceptual ideas into exceptional businesses. They invest in people and ideas for the long run, providing support and resources to help businesses grow and thrive. Their portfolio includes companies like Common Room, Highspot, and Nautilus Bio, among others. The firm also shares insights and thought leadership in the field of technology and entrepreneurship.

About M12:

M12 is Microsoft's venture capital fund, dedicated to accelerating the future of technology through strategic investments, insights, and meaningful partnerships with Microsoft. The fund operates globally, supporting businesses from startup funding to Series C investment. M12's portfolio companies gain access to one of the world's largest technology companies, benefiting from its vast resources and expertise. M12 operates independently of Microsoft's business units, yet it strategically partners with Microsoft and its stakeholders to support its investment areas and portfolio companies. The M12 team brings decades of experience in investing, product innovation, business development, go-to-market strategies, R&D, and entrepreneurship. The fund's investments span a wide range of sectors, and its portfolio companies are enterprise-ready, supporting the digital transformation of Fortune 500 organizations. M12's mission is to bring startup innovation to businesses, helping them future-proof their operations.

About Lightspeed Venture Partners:

Lightspeed Venture Partners is a leading venture capital firm that serves multi-stage companies on a mission to build the future. With a focus on tomorrow's innovations, Lightspeed backs companies across various sectors, helping them transform their visions into reality. In addition to their traditional venture capital activities, Lightspeed has also introduced Lightspeed Faction, an independent team dedicated to the blockchain sector. This demonstrates the firm's commitment to staying at the forefront of emerging technologies. Lightspeed's portfolio includes a diverse range of companies, from beauty brands like Lady Gaga's HAUS LABORATORIES to tech companies like Snap. They also invest in healthcare, with companies like TeneoTwo, and in data control with Rubrik. Their investments reflect a commitment to driving innovation and progress across industries. The firm is known for its growth-investing approach and has recently expanded its operations by opening an office in New York City. Lightspeed's team comprises experienced professionals who have helped establish the firm as a top-tier entity in multi-stage venture capital.

About GV:

GV, formerly known as Google Ventures, is a venture capital investment arm of Alphabet Inc., established in 2009. GV supports innovative founders who are moving the world forward through their groundbreaking ideas and technologies. The firm invests across various sectors including consumer, enterprise, life sciences, and frontier tech. GV's portfolio includes a diverse range of companies, such as GitLab, a platform powering the future of DevOps, and other innovative startups like Chroma Medicine, Checkmate, Push Security, and Typeface. The firm is known for its commitment to supporting the growth and development of these companies. The team at GV consists of partners, executive venture partners, UX research partners, entrepreneurs in residence, and equity, diversity & inclusion partners. They bring a wealth of experience and expertise to the table, helping portfolio companies navigate their growth journeys. GV's operations span across various locations including Cambridge, New York, and San Francisco.