Tractable Secures $65M in Series E Round to Expand AI Services

SoftBank Vision Fund led Investment Round, Joined by Insight Partners and Georgian

Funding Round Info:

Tractable, a prominent player in artificial intelligence (AI) that employs computer vision to evaluate the state of vehicles and residences, has revealed a $65 million Series E funding round. The investment was spearheaded by SoftBank Vision Fund 2, with participation from existing backers Insight Partners and Georgian. Notably, Nahoko Hoshino, Investment Director at SoftBank Investment Advisers, will also join Tractable's board in connection with this transaction. Tractable processes approximately $7 billion in claims each year using its platform, forming partnerships with major insurance companies such as Aviva, Geico, Admiral, and others. With the newly acquired funding, the company has ambitious plans. Firstly, it aims to further expand its existing business. Secondly, Tractable plans to make substantial investments in the Japanese market. Lastly, the funding will enable the integration of cutting-edge AI advancements, allowing Tractable to broaden its services from insurance evaluations to encompass repairs, maintenance, and even sales of the items its platform scans.

About Tractable:

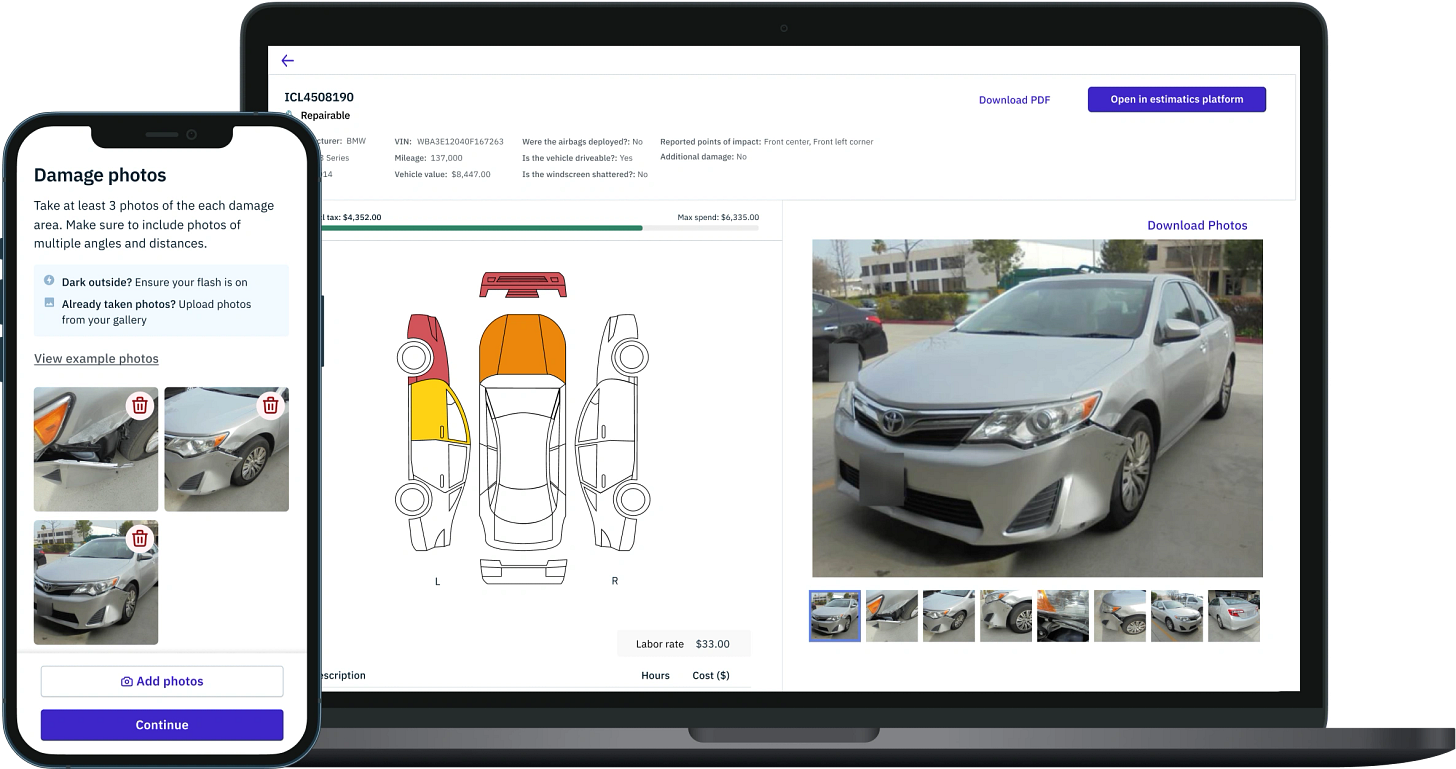

Utilizing extensive training on vast data sets, Tractable's AI evaluates user-submitted photographs of cars and homes taken through smartphones, offering recommendations based on the severity of damages. This efficient process enables drivers to swiftly appraise their vehicles, with Tractable's AI speeding the process up to 10 times faster. Moreover, the company's AI solutions play a pivotal role in the auto collision sector, hastening repairs and facilitating the salvage of vehicle parts for reuse and resale.

About SoftBank Vision Fund:

SoftBank Vision Fund (SVF) 1 and 2 seek to accelerate the AI revolution through investments in market-leading, tech-enabled growth companies, particularly in private companies valued at over $1 billion at the time of investment, colloquially known as “unicorns.” Their global reach, unparalleled ecosystem and patient capital help founders build transformative businesses. Softbank seeks to offer the capital, expertise, and wide-ranging support needed to ensure founders reach their full potential — turning a bold vision into a big impact.

About Insight Partners:

Insight Partners is a global investor in software, specializing in partnering with high-growth technology, software, and Internet startup and ScaleUp companies that are spearheading revolutionary changes in their respective industries. Across the globe, Insight Partners has backed more than 750 companies, witnessing over 55 portfolio companies accomplish an IPO. With its headquarters situated in New York City, the company also maintains offices in London, Tel Aviv, and Palo Alto. Insight's primary goal is to discover, finance, and effectively collaborate with visionary executives, offering them tailored and timely practical, hands-on software expertise throughout their growth journey, starting from their initial investment phase until their IPO.

About Georgian:

Georgian is a fintech company specializing in investing in high-growth technology firms that prioritize the responsible utilization of data. The company aims to develop a platform that enhances the growth capital experience for software company CEOs and their teams. Georgian's platform is specifically designed to identify and expedite the progress of top growth-stage software companies by adopting an intelligent, data-driven strategy to address the challenges faced by CEOs during business expansion. Their investments target high-growth companies throughout North America that prioritize the ethical use of data. With its headquarters located in Toronto, Georgian assembles a diverse team comprising software entrepreneurs, machine learning experts, experienced operators, and investment professionals.