CurvaFix Secures $39M in Series C Round to Expand Medical Products Nationwide

“CurvaFix's ability to benefit patients, physicians, and health systems, while simultaneously addressing the undertreated FFP segment makes CurvaFix a rare asset," said Eric Fritz, MVM Partner.

Funding Round Info:

CurvaFix has secured $39 million in funding, marking the successful completion of a recent funding round. The Series C funding round was led by MVM Life Science Partners, with participation from Sectoral Asset Management and other investors who have previously supported the company. This new funding round builds upon the $10.7 million raised during the Series B round in 2020. The funds obtained will be utilized to expand the treatment of Fragility Fractures of the Pelvis (FFP) across the United States. The company aims to bring about a significant transformation in the care provided to these patients by launching the nationwide introduction of the CurvaFix® IM Implant.

About CurvaFix:

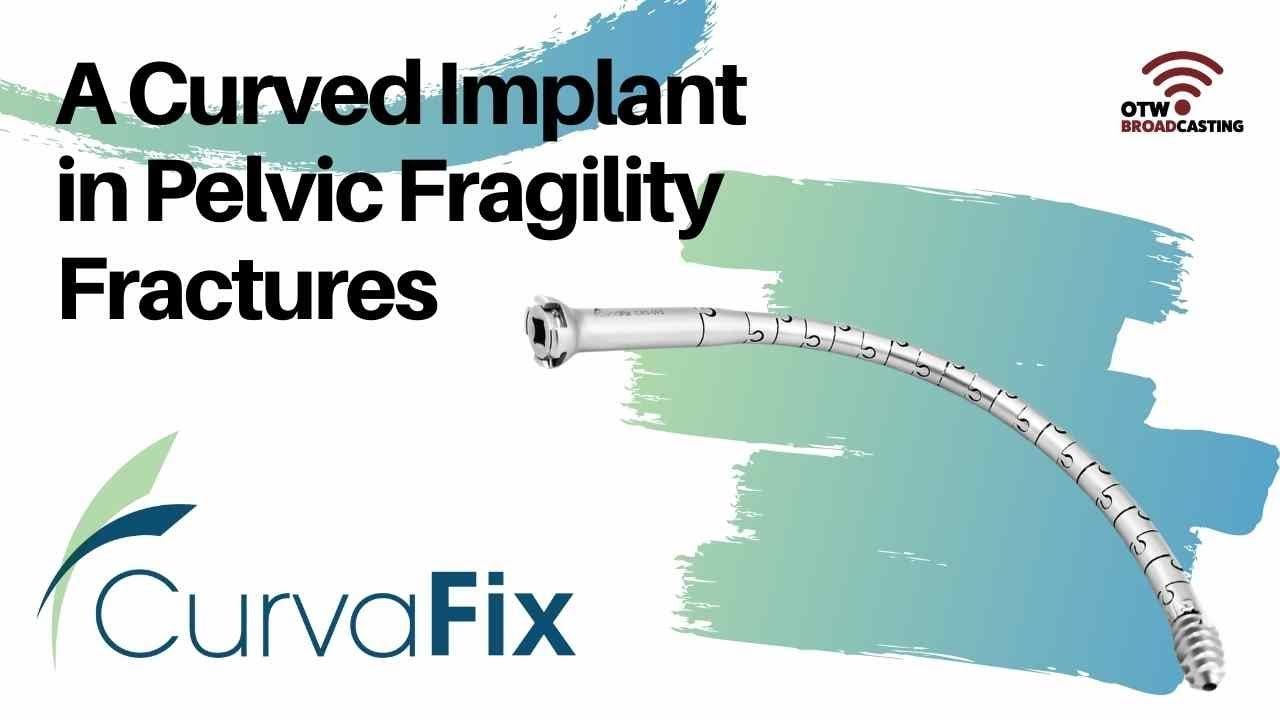

CurvaFix is a privately-held medical device company headquartered in Bellevue, Washington. The company is developing implantable products to transform the treatment of fractures in curved bones. The company is focusing on Fragility Fractures of the Pelvis (FFP) and high-impact pelvic fractures. The CurvaFix® IM Implant is the only intramedullary device capable of following the natural bone shape and filling the space within curved bones such as the pelvis.

About MVM Life Science Partners:

Since 1997, MVM has been actively investing in healthcare businesses with high growth potential. With teams located in both Boston and London, MVM adopts a comprehensive global approach to investments, encompassing various sectors within the healthcare industry. These sectors include medical technology, pharmaceuticals, diagnostics, contract research and manufacturing, digital health, and other relevant areas. MVM's investment strategy focuses on identifying and supporting portfolio companies that address significant unmet needs in sizable markets. This includes targeting medical conditions lacking adequate treatment options, therapies that are prohibitively expensive due to existing technologies, or diseases lacking accurate diagnostic capabilities, among other compelling situations. By investing in such companies, MVM aims to contribute to the advancement of healthcare solutions and bring about positive changes in the industry.

About Sectoral Asset Management:

Sectoral Asset Management is an investment advisor exclusively focused on the global healthcare sector. The company manages public and private equity healthcare strategies for investors around the world. The company has one of the world’s longest track records in managing biotech equities. Currently, Sectoral Asset Management offers four Healthcare strategies: Global Healthcare, Emerging Healthcare, Small & Mid Cap Healthcare & Biotech. Their primary objective is to achieve superior returns for their investors by concentrating on primary research.